Understanding Credit Scores

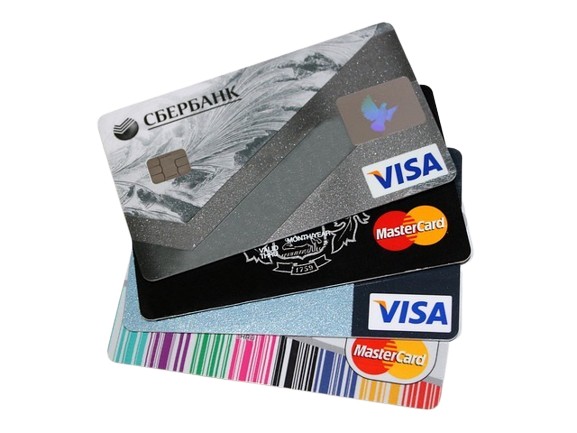

A credit score is a numerical representation of an individual’s creditworthiness, condensing their credit history and financial behavior into a three-digit number. Ranging typically from 300 to 850, a higher score indicates a more robust credit profile, while a lower score suggests potential credit risks. The purpose of a credit score is to assist lenders in assessing the risk of lending money to an individual. This numerical evaluation plays a pivotal role in various financial transactions and decisions.

Consider Sarah, whose credit score is an impressive 780. When she applies for a mortgage, the lender sees her high credit score as a signal of responsible financial behavior, resulting in not only an easy loan approval but also favorable terms and a lower interest rate. On the flip side, John, with a credit score of 550 due to past financial challenges, faces hurdles when applying for a credit card. Lenders view his lower score as an indication of higher risk, leading to stricter terms and a higher interest rate.

| Credit Score Range | Credit Rating |

|---|---|

| 300 - 579 | Poor |

| 580 - 669 | Fair |

| 670 - 739 | Good |

| 740 - 799 | Very Good |

| 800 - 850 | Excellent |

The primary purpose of a credit score is to guide lenders in determining the likelihood of timely repayment by an individual. When applying for loans, credit cards, mortgages, or even rental agreements, a credit score becomes a critical factor in the approval process. A higher credit score often opens doors to more favorable terms, lower interest rates, and increased borrowing capacity. Additionally, employers and insurers may also consider credit scores as part of their assessment processes, further underlining the pervasive influence of these numerical evaluations in the financial landscape. Understanding and actively managing one’s credit score is essential for individuals seeking to navigate the complexities of personal finance and secure favorable opportunities in various aspects of their financial lives.

Components of a Credit Score

Your credit score is like a financial report card, and it’s made up of different parts. Your credit score is like a secret recipe, combining different ingredients to determine your financial health. We’re going to uncover what goes into this number and why it matters. We’ll look at things like how you handle payments, how much credit you’re using, and how long you’ve been in the credit game.

| Credit Score Component | Weight |

|---|---|

| Payment History | 35% |

| Credit Utilization | 30% |

| Length of Credit History | 15% |

| Types of Credit in Use | 10% |

| New Credit | 10% |

- Payment History (35%): This is the report card of your financial discipline. Every on-time payment is a gold star, while late payments or missed assignments hurt your score. For instance, Sarah consistently pays her credit card bill on time, securing a high credit score. In contrast, John’s occasional late payments due to forgetfulness bring his score down.

- Credit Utilization (30%): Picture your credit limit as a pizza. The amount you eat (credit you use) compared to the whole pizza (your limit) is crucial. Keeping your slice below a certain size, ideally 30%, is key. Mary never devours more than 30% of her pizza (credit limit), maintaining a healthy credit utilization ratio. On the flip side, Tom, who frequently maxes out his credit card, ends up hurting his credit score.

- Length of Credit History (15%): Consider your credit history as a movie. The longer the film has been playing, the better. Lisa, with a decade-long credit card history, enjoys a positive impact on her credit score. James, who recently joined the credit scene, has a shorter credit history, potentially affecting his score.

- Types of Credit in Use (10%): Imagine your credit as a wardrobe. Having different types of clothes (credit cards, mortgages, and loans) is stylish. Mike manages a diverse wardrobe, utilizing credit cards, a car loan, and a mortgage, enhancing his credit profile. In contrast, Emily relies solely on credit cards, limiting the diversity of her credit accounts.

- New Credit (10%): Opening new credit is like trying new flavors. Moderation is key. Mark, eager to taste everything, applies for several credit cards within a short period, impacting his credit score negatively. Susan, savoring one flavor at a time, strategically opens a single credit account, minimizing the impact on her score.

Unlocking Financial Doors: Importance of a Credit Score

Your credit score is more than just a number; it’s a financial passport that opens doors to various opportunities. Understanding the significance of a good credit score is crucial for navigating the complexities of the financial landscape. Let’s explore why having a strong credit score matters in different aspects of your financial journey

1. Loan Approval and Interest Rates:

A good credit score significantly increases the likelihood of loan approval and can lead to lower interest rates. Lenders view a high credit score as an indicator of reliable repayment behavior. Example: Alex, with an excellent credit score, easily secures a mortgage with a low-interest rate. In contrast, Emma, with a lower score, faces challenges and higher interest rates when applying for a loan.

2. Credit Card Approvals:

Credit card companies often consider credit scores when approving applications. A good credit score opens the door to premium credit cards with attractive rewards and better terms. Example: Jake, with a high credit score, is approved for a premium credit card with attractive rewards. Lisa, with a lower score, is approved for a card with higher fees and fewer benefits.

3. Renting a Home:

Landlords commonly use credit scores to assess a tenant’s financial responsibility. A good credit score can make it easier to secure rental housing without additional hurdles. Example: Sarah’s excellent credit score allows her to easily rent an apartment, while Chris, with a lower score, faces challenges and may require a co-signer.

4. Employment Opportunities:

Some employers check credit scores, especially for roles involving financial responsibilities. A good credit score can enhance employability in certain positions. Example: Lisa, with a strong credit history, is considered for a finance-related position. John, with a lower credit score due to past financial challenges, faces obstacles in securing a similar role.

5. Insurance Premiums:

Insurers may consider credit scores when determining premiums for auto and homeowners insurance. A good credit score may result in lower insurance costs. Example: Sarah, with an excellent credit score, enjoys lower insurance premiums for her car and home. Tom, with a lower score, faces higher premiums.

A good credit score is a financial asset that not only facilitates access to credit but also enhances your financial well-being. It’s a reflection of your responsible financial behavior and can significantly impact your ability to achieve various financial goals. Whether you’re looking to buy a home, secure a credit card, rent an apartment, or even land a job, a good credit score acts as a key that unlocks doors to favorable opportunities and financial success.

Practical Tips for Managing Your Credit Score

Managing your credit score effectively is a key aspect of financial well-being. Regularly checking your credit report ensures the accuracy of the information and allows you to spot any errors or unauthorized activities. Timely payment of bills is foundational to a good credit score, and setting up automatic payments or reminders can help ensure payments are made promptly. It’s crucial to manage your credit utilization by aiming to use only a portion of your available credit, ideally keeping the credit utilization ratio below 30%. Diversifying your credit mix by having various types of credit, such as credit cards, loans, and mortgages, can positively impact your credit score.

When considering new accounts, be cautious about opening too many at once, as this may be perceived as risky behavior. Keeping old accounts open, even if not actively used, contributes positively to the length of your credit history. Exercise care when closing credit cards, as it can affect your credit utilization ratio. Addressing outstanding debts strategically, prioritizing high-interest debts, is essential for overall financial health. Seeking professional advice from credit counseling services can be beneficial when facing financial challenges. Finally, building and maintaining a good credit score require patience and persistence. By following these practical tips, you can confidently navigate the credit score maze, ensuring your financial compass points toward a bright and stable future.

Conclusion

In summary, mastering your credit score is pivotal for financial success. The components—payment history, credit utilization, credit history length, types of credit, and new credit—interweave to shape your financial profile. The impact of a strong credit score resonates across loans, credit cards, rentals, employment, and insurance. Strategic management, from regular credit report checks to thoughtful debt handling, guides this journey. Recognizing that your credit score is not just a number but a reflection of financial habits empowers you to take control. Ultimately, a well-mastered credit score acts as a key, unlocking doors to financial opportunities and a secure future.