Have you ever wondered how successful people like Warren Buffett seem to effortlessly grow their wealth? It’s not magic; it’s about understanding simple yet powerful strategies to make your money work for you. Imagine your money as a little helper that, with the right guidance, can bring more friends along the way. Instead of just letting her money sit in her wallet, we shall put it to work, much like leading stock market investors Warren Buffett, investing wisely in groundbreaking projects. These financial “seeds,” when cared for properly, have the potential to grow into something bigger over time.

We’ll explore practical steps inspired by the strategies of successful individuals. From setting clear goals to making informed choices about spending and saving, we’ll unravel the secrets behind making your money work smarter. We’ll break down complex ideas into simple, easy-to-follow steps, using real-world examples.

Whether you’re starting with a little or a lot, the principles remain the same. Making your money work for you is about being intentional, making your dollars count, and watching them grow into a financial garden that reflects your goals and aspirations.

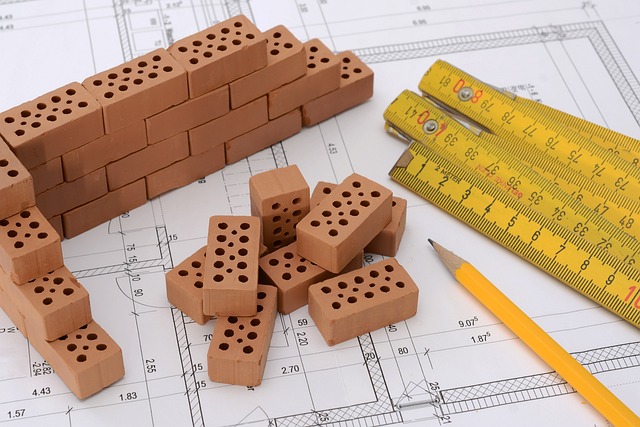

Setting Financial Goals: A Blueprint for Success

Creating a plan for your money journey is like making a blueprint for a building—it needs careful thought. When we talk about setting financial goals, think of it as more than just a wish; it’s about deciding what you want your money to do for you. Setting financial goals is like drawing a map with clear points that take you closer to your dreams. It’s about more than just saving money; it’s about deciding what’s important—like saving for special things or making sure you have money for unexpected situations. These goals are

Think of an architect planning a blueprint for a building. Each financial goal is like a specific, measurable, and time-bound part of the plan. It’s not just about saving; it’s about thinking ahead for big and small goals. But plans need to be flexible, especially when unexpected things happen. Setting financial goals is something anyone can do—it’s a tool to take charge of your money future.

For Example: Rene, a young professional with aspirations for financial success. Rene decides to embark on a money adventure. His first mission? Saving up for something special—an upgraded camera for his photography passion. Instead of just daydreaming, Rene takes action. He plans to set aside a small amount of money every month, creating a roadmap to turn his camera dream into a reality. This goal is like a helpful guidepost on his money journey, keeping him motivated and on track.

Now, life throws a curveball at Rene—a surprise car repair. But Rene is prepared. He adjusts his money plan a bit, showing flexibility and resilience. This adaptability is what makes setting money goals so powerful for Rene. It’s not just about saving; it’s about having a flexible plan that helps navigate unexpected turns on his unique money path.

Budgeting Basics: Mastering the Art of Money Management

Understanding budgeting is like having a map for your money journey. It’s the first step in learning how to manage your money wisely. Imagine you have a plan that shows exactly where your money goes each month—what you need to spend on important things like rent and groceries, and what’s left for things you enjoy.

Budgeting means creating this plan. It helps you see if you’re spending more money than you have and allows you to set aside some money for things you want to do in the future, like going on a trip or saving for emergencies. It’s like having a financial compass, guiding you to make decisions that keep your money in good shape. As we explore budgeting basics, we’ll discover simple steps to help you manage your money well and make it work for you.

For example budgeting basics:

Rene eager to unravel the secrets of budgeting. Imagine budgeting as a treasure map for his money, guiding him through the twists and turns of expenses and income. Rene starts by taking stock of what he earns and then carefully maps out where his money needs to go, from essential bills to everyday spending.

Discovering budgeting’s magic, Rene realizes it’s about more than just tracking expenses; it’s a tool for smart money decisions. Setting aside a portion of his income for savings becomes his secret weapon, creating a safety net for any unexpected surprises. Budgeting also empowers Rene to set clear financial goals—whether it’s saving for a new gadget or planning a weekend getaway. There are various kinds of budgeting tools available, which Rene can use to create, plan & monitor his budget.

Budgeting tools come in various shapes and sizes, catering to the diverse preferences of individuals seeking financial management assistance. For those comfortable with technology, budgeting apps such as Mint or YNAB offer seamless integration with bank accounts, automating expense tracking and providing real-time insights into spending patterns. These apps often come equipped with features like goal setting, customizable budget categories, and alerts to help users stay on track. Moreover, online banking platforms frequently provide built-in budgeting tools, enabling users to monitor transactions, categorize spending, and set financial goals directly within their banking interface.

Investing Insights: World of Investment Options

Entering the world of investments requires a thoughtful approach and an understanding of the diverse options available. Investing is essentially putting money to work with the expectation of earning a return, and there are several avenues to explore.

One common investment option is the stock market, where individuals can buy shares of publicly traded companies. Stocks offer the potential for capital appreciation as companies grow and succeed. However, they also come with the risk of market fluctuations. For those seeking a diversified approach, mutual funds pool money from various investors to invest in a diversified portfolio of stocks, bonds, or other assets. This can spread risk and potentially provide steady returns.

Other option is Bonds, bonds are debt securities where investors lend money to governments or corporations in exchange for periodic interest payments and the return of principal at maturity. Bonds are generally considered lower risk compared to stocks.

In recent years, the rise of digital platforms has popularized robo-advisors, automated investment services that use algorithms to create and manage a diversified portfolio for investors based on their risk tolerance and financial goals. This provides a hands-off approach for those who prefer a more automated investment strategy.

Commodities, such as gold or oil, are tangible assets that investors can consider for diversification. Additionally, the emergence of cryptocurrencies has introduced a new frontier in investing. Cryptocurrencies like Bitcoin and Ethereum operate on decentralized technology, providing an alternative investment option with its own set of risks and rewards.

While the options may seem overwhelming, the key to successful investing lies in understanding one’s financial goals, risk tolerance, and time horizon. Seeking professional advice or conducting thorough research before making investment decisions can empower individuals to navigate the vast landscape of investment options and make informed choices aligned with their financial objectives.

Real Estate Wealth: Exploring Opportunities for Growth

Investing in real estate stands as a robust avenue for wealth creation, offering various opportunities for growth and financial stability. One of the primary ways individuals venture into real estate is through property ownership. Owning residential or commercial properties not only provides a tangible asset but also opens avenues for generating income through rent. Rental income can serve as a consistent cash flow, especially in areas with high demand for housing or commercial space. Additionally, as property values appreciate over time, investors can build equity, further enhancing their overall wealth.

Another promising avenue within real estate investment is Real Estate Investment Trusts (REITs). REITs are companies that own, operate, or finance income-generating real estate across various sectors. Investors can buy shares of REITs, providing an opportunity to diversify their real estate holdings without the direct responsibilities of property management. REITs often focus on specific types of properties, such as residential apartments, office buildings, or shopping centers, allowing investors to tailor their real estate portfolio to their preferences and risk tolerance.

Furthermore, the concept of real estate crowdfunding has gained traction in recent years. Through online platforms, individuals can pool their resources to invest in larger real estate projects, such as residential developments or commercial ventures. This democratization of real estate investment allows even those with smaller budgets to access a broader range of opportunities. Real estate crowdfunding platforms provide transparency and accessibility, making it easier for investors to explore and participate in projects that align with their financial goals.

Example:

Rene and Tim, both exploring distinct paths within real estate for wealth creation. Rene, inspired by the idea of property ownership, invested in residential real estate. Through careful management and rental income, he experienced not only a consistent cash flow but also witnessed the appreciation of property values, steadily building his wealth over time.

On the other hand, Tim opted for a more hands-off approach. He chose to invest in Real Estate Investment Trusts (REITs), buying shares in companies managing various real estate assets. This allowed Tim to diversify his real estate holdings without directly dealing with property management. Both Rene and Tim showcase the versatility of real estate as an avenue for wealth growth, demonstrating that whether through property ownership or REITs, real estate offers diverse opportunities for financial success.

Compound Interest Magic: The Power of Early Investing

The concept of compound interest serves as a financial catalyst, particularly when embraced through early investing. This phenomenon unfolds as the interest earned on an investment generates additional earnings, setting in motion a compounding effect over time. The crux lies in the realization that the earlier one initiates their investment journey, the more time their money has to experience the exponential growth facilitated by compound interest.

When individuals embark on the path of early investing, they provide their money with an extended runway for compounding. This becomes particularly impactful in long-term investment scenarios, such as retirement funds or plans for future financial objectives. The essence of the compound interest magic underscores the notion that time is a crucial ally in the wealth accumulation journey. As financial wisdom dictates, the optimal moment to commence investing is now, allowing individuals to unlock the full potential of compound interest and witness the substantial growth of their financial assets over time.

Example:

Rene, a forward-thinking investor navigating the dynamic realm of the stock market. Rene recognized the potential of early investing and strategically entered the market in his early thirties with an initial investment of $10,000. His investment journey features prominent players like Tesla, Microsoft, and Amazon, each contributing to his financial success.

Rene’s foresight led him to invest $10,000 in Tesla during its early growth phase. With an impressive average annual return of 10%, Rene’s initial investment of $10,000 in Tesla compounded over the 15-year period, resulting in a substantial value well beyond the initial investment.

Rene’s initial investment of $10,000 is projected to grow to approximately $41,770 after 15 years. These strategic investments exemplify Rene’s ability to identify companies with long-term growth potential, highlighting the substantial returns achieved through compounding over 15 years. As Rene continues to navigate the stock market with acumen, his portfolio serves as a testament to the opportunities available for those who approach investing with a keen understanding of market dynamics and a long-term perspective.

Diversification Strategies: Safeguarding Investment Portfolio

Diversifying your investment portfolio is a crucial strategy for mitigating risk and enhancing the potential for long-term success. Rather than putting all your eggs in one basket, diversification involves spreading investments across different assets, sectors, or geographic regions. This approach aims to create a well-balanced portfolio that can withstand market fluctuations and economic uncertainties.

One key aspect of diversification is allocating investments across various asset classes. This may include stocks, bonds, real estate, and other financial instruments. Different asset classes respond differently to market conditions, and having a mix can help buffer against losses in any single category. For instance, while stocks may offer high returns, bonds can provide stability during market downturns.

Sector diversification is another essential component. Investing across different sectors, such as technology, healthcare, and finance, ensures that your portfolio isn’t overly reliant on the performance of a single industry. Economic conditions impact sectors differently, and a diversified portfolio can adapt to changes in the business cycle.

Geographic diversification expands the reach of your investments globally. Allocating funds to various regions can shield your portfolio from risks associated with regional economic downturns or geopolitical events. A globally diversified portfolio may include exposure to developed and emerging markets, offering a more comprehensive risk management strategy.

By implementing diversification strategies, investors aim to achieve a balance between risk and return. While diversification doesn’t guarantee profits or prevent losses, it provides a risk management framework that can enhance the resilience of your investment portfolio. Safeguarding against the unpredictability of financial markets, diversification remains a fundamental principle for prudent and strategic investors aiming for long-term financial success.

Reinvestment Strategies: Amplifying Wealth Through Profits

Reinvestment strategies play a pivotal role in maximizing wealth through strategic allocation of profits. Instead of solely enjoying the returns generated from investments, reinvestment involves channeling those returns back into the market to generate additional income and foster the growth of one’s financial portfolio.

One fundamental reinvestment strategy involves the compounding of returns. Rather than cashing out profits, investors choose to reinvest the earnings back into the same or different assets. This compounding effect results in exponential growth over time, as each reinvested dollar has the potential to generate further returns.

Dividend reinvestment is another powerful strategy, particularly for those holding dividend-paying stocks. Instead of receiving dividends in cash, investors opt to reinvest these earnings back into additional shares of the same stock. This not only enhances the number of shares owned but also increases the potential for future dividend payouts.

For those in fixed-income investments like bonds, interest earned can be reinvested. Reallocating interest payments into additional bonds or other income-generating instruments contributes to the compounding effect, amplifying overall returns. Reinvestment strategies are not limited to securities; real estate investors can also benefit. Reinvesting rental income or profits from property sales into additional real estate assets can accelerate wealth accumulation through property appreciation and rental income growth.

Example:

Rene decided to invest $10,000 in a diversified portfolio with an average annual return of 10%. Additionally, the chosen investment offers a 2% annual dividend yield. The investor opts for a strategic approach, reinvesting both the dividends received and any additional contributions back into the portfolio.

After 20 years of consistent reinvestment and compounding, the initial $10,000 investment has the potential to grow substantially. The total investment could potentially grow to approximately $67,275. This estimate considers the compounding effect of both market appreciation and reinvested dividends, showcasing the potential impact of strategic reinvestment strategies in wealth accumulation over the specified time frame.

Continuous Learning: Staying Informed in Financial Markets

In the dynamic landscape of financial markets, the commitment to continuous learning is paramount for individuals navigating the complexities of investments, economic trends, and market fluctuations. Staying informed not only empowers investors with the knowledge needed to make sound financial decisions but also positions them to adapt to evolving market conditions.

Engaging in continuous learning involves staying abreast of economic indicators, market analyses, and financial news. This commitment enables investors to understand the factors influencing market movements and make informed decisions aligned with their financial goals. Whether it’s keeping up with global economic developments, studying company financials, or monitoring geopolitical events, the process of continuous learning provides a comprehensive view of the forces shaping the financial landscape.

Moreover, technological advancements and the availability of online resources have made learning more accessible than ever. Investors can leverage educational platforms, webinars, and reputable financial publications to deepen their understanding of investment strategies, risk management, and emerging opportunities. Embracing continuous learning is not just a proactive measure; it’s a mindset that empowers individuals to navigate the ever-changing financial terrain with confidence and resilience.

Conclusion:

Achieving financial success requires a strategic approach to make your money work for you. By embracing smart investment decisions, budgeting, and continuously expanding financial literacy, individuals can unlock the full potential of their resources. The key lies in balancing risk and reward, making informed choices, and adapting to changing economic landscapes. Whether through savvy investments, prudent savings, or effective budget management, the journey to financial success is a dynamic process that demands ongoing learning and adaptability. Ultimately, the ability to harness one’s financial resources fosters resilience and opens doors to long-term prosperity.